Business sure isn’t what it used to be. The rules have changed drastically; venerated business models and long-established financial paradigms are collapsing under the weight of heretofore unimaginable stresses, rendered hopelessly obsolete by the viciously fast pace of new moveable markets in our digitally-connected world. No foolproof strategies have emerged to replace the fallen stand-bys. It’s a whole new game.

Business sure isn’t what it used to be. The rules have changed drastically; venerated business models and long-established financial paradigms are collapsing under the weight of heretofore unimaginable stresses, rendered hopelessly obsolete by the viciously fast pace of new moveable markets in our digitally-connected world. No foolproof strategies have emerged to replace the fallen stand-bys. It’s a whole new game.

The old system was flawed, devoted as it was to a single goal it elevated like an all-mighty brazen idol. Countless companies and an unimaginable amount of resources— both human and material— burned in the fiery mouth of that idol, sacrificed to the goal economists believed was the alpha and omega of all commerce. The name of that goal? GROWTH.

But staking everything on your ability to sustain an infinite amount of growth ignores the fact that all markets are finite. Constant growth cannot be perpetually sustained in ANY system— eventually the system will fail, collapsing into formless chaos. Nevertheless, for the past century the business world has considered “perpetual exponential growth” the Holy Grail of all business endeavors.

Which, upon further consideration, is a bit odd. Because when a cell gets that ambitious in the human body, we call it “cancer.” And we don’t like it.

Anyone who has studied basic economics (or who has ever gone nuts with a mouthful of bubblegum) should know that any construct, (physical or financial) in “bubble” form cannot inflate forever. You can feed it and carefully tend it as it grows larger, but the bubble must ultimately burst. When it does, it leaves a big empty hole in the space it formally occupied. If the bubble is an “investment bubble,” like the European Tulip craze or the South Sea Company speculation debacle of the 17th and 18th centuries, expect a lot of “value” to suddenly vaporize (along with the fortunes of most involved) when the bubble goes “pop.”

In 20th century finance the whole damn system was a bubble, especially in the United States. Economic expansion was demanded by impoverished survivors of the Great Depression. Politicians were elected who promised growth. Growth became the goal whereby all poverty could be permanently extinguished from the American landscape. The government started sinking tax dollars into endless plans and programs to expand business, ensuring that American commerce would grow, grow, grow!

When growth waned financial gurus and business wizards invented clever new ways to keep the bubble inflating… anything to avoid the most terrible of all possibilities: RECESSION. The economy (it was believed) must never be allowed to stabilize or recede; it must expand indefinitely. One side-effect of bubble-maintenance was “stagflation,” in which cost-of-business-break-even ratios and wages remain stagnant while creeping inflation reduces the actual value of the currency, keeping the books balanced and maintaining an empty illusion of growth. Export of industry to cheaper foreign markets did the same, as did the greedy creation of a sustainable perpetual war economy in which most war-profit is hijacked into off-shore holdings and private interests.

No system can endure such abuse forever. Like a rubber band stretched too far, our economy has now violently snapped back. Too many greedy fools tugged too hard on it, hoping to pad their pockets and make a getaway before the great backlash occurred. Well, it finally did. Trust me… no matter what politicians we elect, we’ll be stuck in the economic doldrums for decades to come, and none of the old tricks work anymore. When the Federal Open Market Committee sought to re-inflate the economy in 2008 by lowering federal funds interest rates (as in the past), they made the shocking discovery that IT DIDN’T WORK ANYMORE. They took the drastic step of lowering the federal interest rate all the way down to zero, and it STILL didn’t jump-start the economy. At that point, economics experts began tossing their text books in the trash. Meanwhile others continue desperately trying to repair the all-mighty bubble.

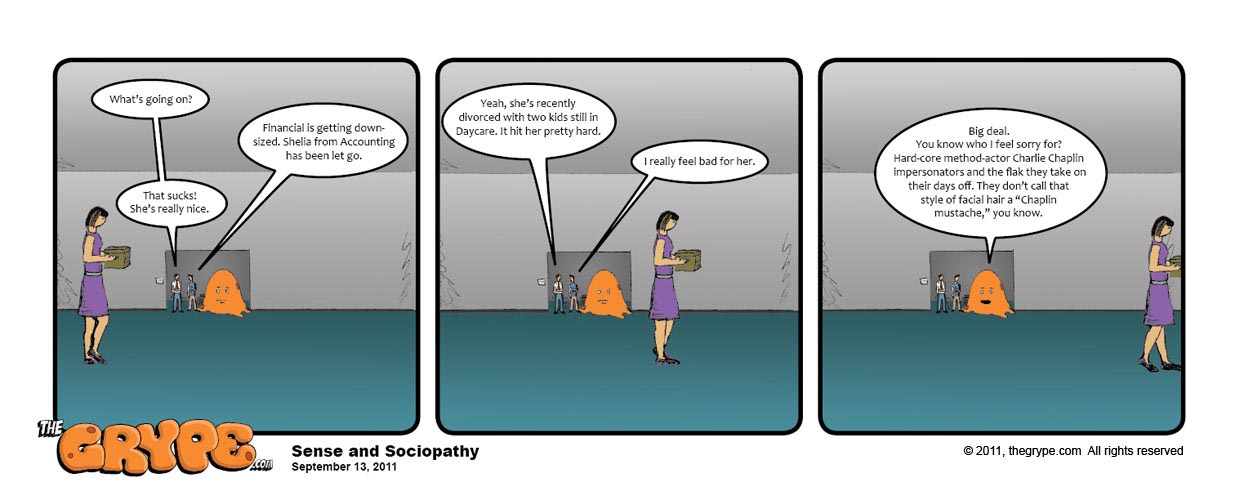

But bubbles only get that big when they are full of hot air, and our economy has way too much “hat” and not enough “cat.” I guess “the joy of downsizing” should be our new mantra, since we’re probably stuck with it for the foreseeable future.